This afternoon Google parent Alphabet delivered a strong quarter, beating Wall Street’s revenue and earnings expectations. Revenues grew at 20 percent year over year. Net income was $6.3 billion.

Total quarterly revenues were $22.25 billion (ad revenues were $19.8 billion), while so-called “other bets” generated $197 million (mostly Nest and Fiber). That was an increase vs. last year. There was also a smaller loss of $865 million on other bets compared to a year ago.

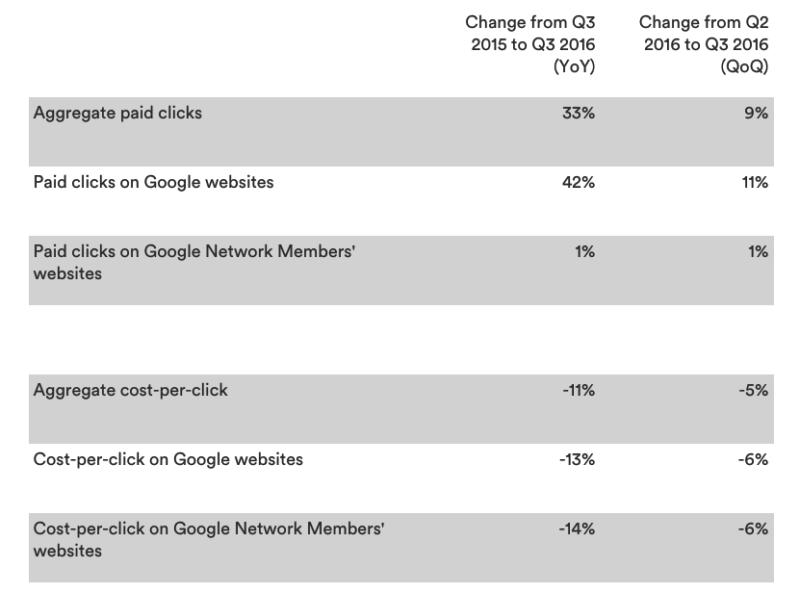

Paid clicks were up an impressive 33 percent (Google website clicks were up 42 percent) however aggregate cost-per-click across Google and its network were off 11 percent. Traffic acquisition costs were roughly $4.2 billion, representing 21 percent of total ad revenue.

Last quarter Alphabet CFO Ruth Porat said that revenue growth was driven primarily by mobile search. But the company also cited video and programmatic as strong areas of growth. Porat said that in Q3 mobile search was also the big growth driver with a strong contribution from YouTube. She added that desktop search was still seeing “decent growth.”

Google has $83.1 billion in cash and cash equivalents on hand, 60 percent of which is overseas.