“Mobile wallet” conjures up the virtual equivalent of a worn leather billfold harboring credit cards, coupons, boarding passes, and discount cards.

But that’s only because its name is borrowed from the wallet’s heyday, when all “stores” were tangible. The future of the humble mobile wallet may turn out to be something much more unique than acting as a billfold-substitute.

Corey Gault, director of communications of mobile engagement provider Urban Airship, told me via email that his company believes “mobile wallets will become [a] marketing platform” within six to twelve months.

According to the company’s most recent “State of Mobile Wallet Marketing” survey of 2000 smartphone users, 54 percent of respondents have employed wallets and 30 percent have done so in the week before the survey. The most common uses are as loyalty cards, coupons, and boarding passes. But half of the respondents also want to use it for order delivery updates, mobile payment, ID cards, event cards, and reminders of things like expirations or account balances.

“The real aha moment,” he said, “is that mobile wallets offer a rich and sustainable customer communications channel with lockscreen notifications and passes that update dynamically.”

“Seventy-seven percent of respondents want coupons to automatically update to new offers on expiration,” he added.

But automatic updating of the content on the wallet cards isn’t limited to coupons.

‘A channel’

As mobile marketing firm Vibes VP of technology Ken Kunz told me, the mobile wallet is “a channel into a customer’s device.”

That’s because the cards that populate the wallet — as coupons or boarding passes, for instance — contain text, links and images that can be updated remotely by the card provider.

Urban Airship’s Gault pointed out that, on Apple Wallet, the back of the wallet card contains links and the front uses images and text. The Android Pay wallet doesn’t have backs on its passes, so its content and links are limited to the front.

But links, text, and static images may only be the beginning. Gault said he wouldn’t “be surprised if wallet passes started supporting animated GIFs and video.”

Boston NPR station WBUR, working with Urban Airport, has developed a wallet card to let users know when it has a new podcast. The link to the new podcast is updated remotely on the card along with some new content, and Apple users get a notification that there’s an update.

In Apple Wallets, the user can receive a locked screen notification when there’s an update, and a link to the updated card; Vibes’ Kunz said Google is moving in the direction of offering such notifications.

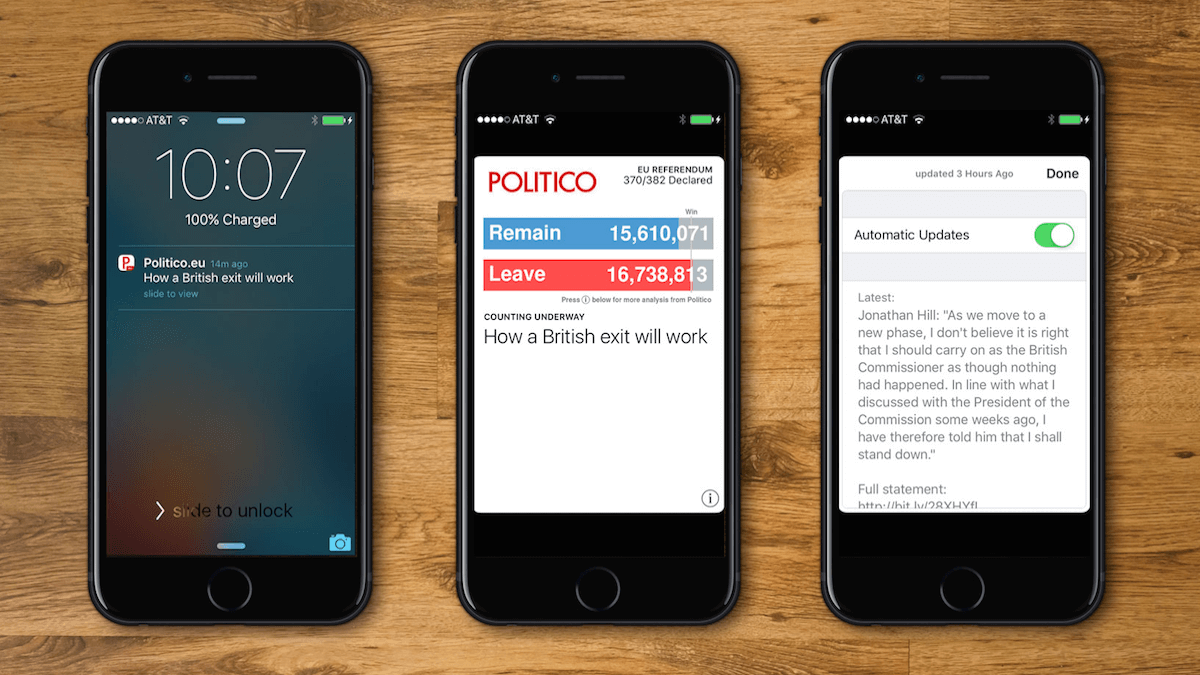

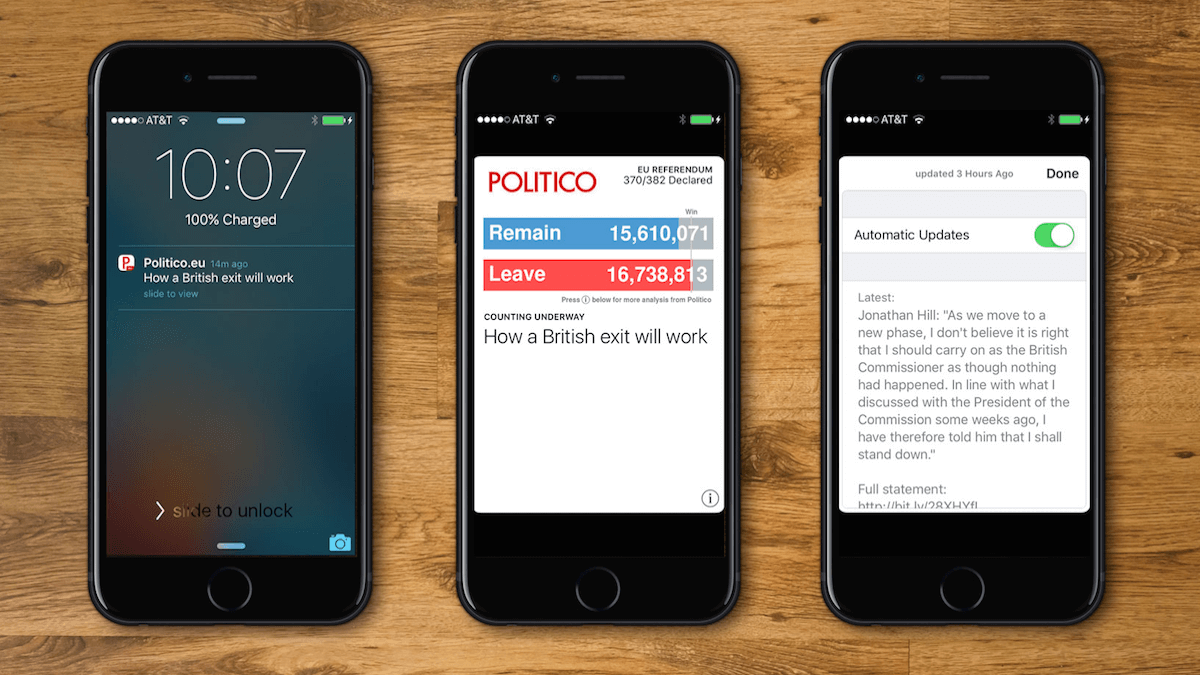

Similarly, Urban Airship created an updateable sweepstakes entry as a wallet card for a project it did with Sprint and a soccer tournament. And, for the political blog Politico Europe, the mobile engagement firm distributed a wallet pass (see images at top of this page) that was regularly updated to show the ongoing results of the Brexit referendum vote for or against the UK remaining in the European Union. That is, a kind of personal news ticker.

In short, a wallet card is a misnomer. Essentially, it’s a card format that provides an open-ended publishing stream into a user’s phone.

‘Casual fans of your brand’

Open-ended because the cards are lightweight in file size, living in a user’s wallet indefinitely. Users rarely clean out their wallets to open up needed space, as they regularly need to do with apps. According to Urban Airship, only ten to 20 percent of wallet passes are deleted, even if their promotions are over.

That’s only one of the benefits that mobile wallet cards have over apps. The mobile wallet offers a stream of refreshable brand-specific content that doesn’t require you to go to an app store, download an app, and keep the app until you need the space.

It’s also available from more sources than apps, which primarily reside in app stores.

Wallet cards for whatever purpose can be downloaded from a link in an email, on a web page, in a SMS message, in a social post, or elsewhere. Jay Hawkins, SVP for Client Success at Chicago-based local marketing firm SIM Partners, pointed to a search/download use case, where someone searches for “winter boots” with “special offer” on a smartphone, and clicks on the resulting link to add the special offer card to the wallet.

Urban Airship SVP of Product and Engineering Mike Herrick noted that “casual fans of your brand” might download a brand-related wallet card, even if they didn’t have the commitment usually required to download the brand’s app. Wallet cards are also relatively inexpensive and quick to create. The Politico project, according to Urban Airship, took three weeks.

But mobile wallets have another key talent, besides the ability to act as a communications channel. They know where they are.

Wallet cards can be location-aware by GPS/latitude-longitude, or by beacons. Urban Airship says that 63 percent of users are more likely to visit a nearby store when the wallet card shows a location-aware notification.

Apple Wallet supports up to ten lat/long geo-fences, plus up to ten beacon IDs. Android Pay has no geo-fence limit, but it doesn’t yet handle beacons. Beacons offer finer location granularity that lat/long, and similar beacon locations can transmit similar IDs across a chain of stores.

The barely-tapped value

For instance, a department store chain might have the same ID for all beacons in its shoe departments, triggering the same wallet coupon across stores. Location-awareness is what allows your boarding pass in your wallet to pop up when you get near the airport gate, providing another unique feature for mobile wallets.

This location awareness supports what Vibes Product Manager Sonal Patel describes as the mobile wallet’s biggest asset: functioning as “a direct marketing channel optimized for brick and mortar experiences,” bringing together payment, rewards, and discounts.

But mobile wallets also contain another barely-tapped value for marketers: data.

Right now, Patel said, if you use a mobile wallet to “tap and go” at a point of sale to make a purchase — employing your credit card and any loyalty cards or coupons — the data for that transaction usually stays at the retailer. So, if you pay for your Starbucks order and accrue loyalty points, only Starbucks knows about that transaction or even that you have a Starbucks loyalty card.

Moving that data to mobile profiles would “close the loop” on how customers react to offers, and enable follow-up targeting. Patel said the data trapped in mobile wallets or retailers could become available for other parts of the marketing ecosystem within a few years.

In short, mobile wallets occupy a place in-between, which Patel described as “not exactly an app, [and] not exactly a web site.” But, Urban Airship’s Herrick said, mobile cards “could absolutely evolve” into mini-apps, such as having content that adapted to a user’s behavior.

A discount card for coffee at Starbucks, for instance, could automatically add discounts for Barnes & Noble books, because it knows you’ve been getting your daily caffeine fix in the Starbucks shop inside the local outlet of that bookselling chain.

And, a bit further down the road, mobile wallets could become a quick way to interact with the Internet of Things.

Danielle Brown, VP of marketing at loyalty solution manager Points, described this possibility to me as an “intuitive personalization of options, offers and functionality.” A wallet’s location awareness could mean, for instance, that a discount card pops up on my phone when I’m near my smart refrigerator, reminding me that I haven’t purchased milk since I use this same discount card a week ago.

The mobile wallet only seems like a pocket for some static cards, like a virtual twin to my real wallet. But wait till it grows up.